Ratio Analysis

Valuations

Charting Technique

- Popularly known as WACC

- Based on WACC Investors conclude feasibility to undertake the project

- it denotes the rate that is used to discount UNLIVERED FREE CASHFLOWS and TERMINAL VALUE

- WACC shouldn't capital specific., i.e it denotes all the capital Debt,Equity..., Rational behind this is: Cashflow represents to all types of capital(debt+equity)

- WACC should be after Taxe., as Cashflow represents to post tax values

- Denotes about the costs associated with the company to maintain stock Price

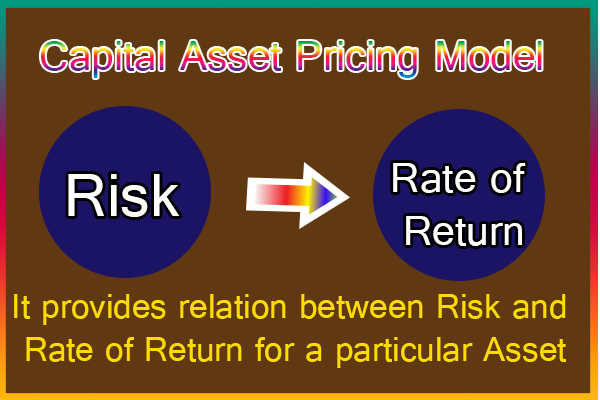

- CAPM denotes CAPITAL ASSET PRICING MODEL

- It determines Rate of return of a Security after considering its risk

- It provides the relation between RISK and RATE OF RETURN for a particular asset

- It is used to calculate required rate of return of a risky asset

- Ra = Expected Rate of Return

- Rf = Risk free rate of Return

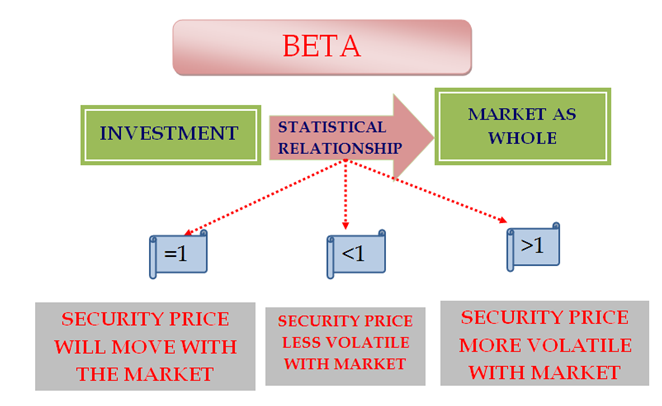

- Beta - Denotes about Risk

- Rm = Market rate of return

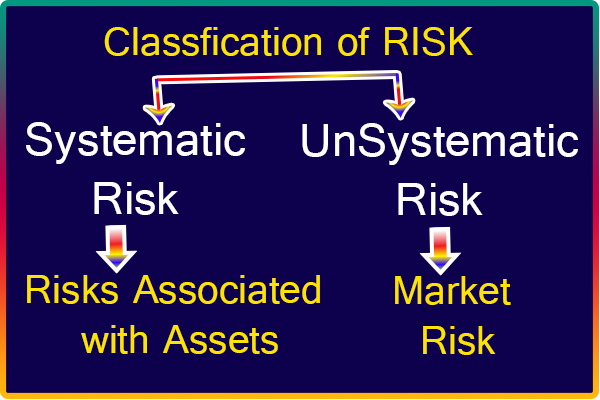

- We can classify risk in two

- UnSystematic Risk associated to Asset Specific Risk

- Systematic risk associated with RISK TO ALL ASSETS

- BETA calculates SYSTEMTIC RISK

- If Beta is > 1, asset risker than Market

- If Beta is < 1, Asset is less risky than Market

- Re = Cost of Equity

- Rf = Risk Free Rate

- Denotes about the Rate the company pay to DEBT HOLDERS

- As companies attains benefits from the TAX deductions on INTEREST PAID, Interest considered based on NET of TAX

Weighted Average Cost of Capital

What is meant by WACC

Points to Remember:

Cost of Equity

CAPM is the method where we can calculate COST OF EQUITY:

Capital Asset Pricing Model

Ra = Rf + Beta(Rm-Rf)

Beta = Risk Premium

Beta RISK Classification:

(i)Systematic Risk (ii) Unsystematic Rick

CAPM Calculation:

Beta:

Equity Market Risk Premium(EMRP):

Cost of Debt

Debt(1-TaxRate)