Ratio Analysis

Valuations

Charting Technique

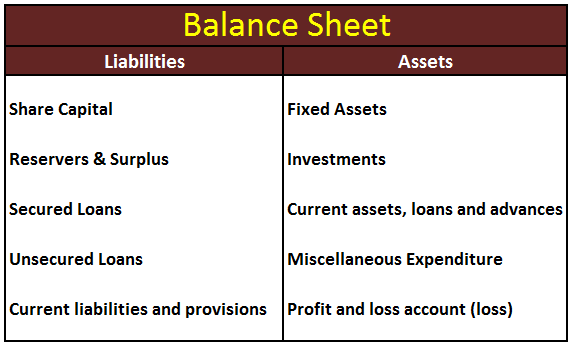

- It states FINANCIAL POSITION of the company.

- A balance sheet shows the FINANCIAL POSITION of a Company at a point in time.

- It reports at at specific Date

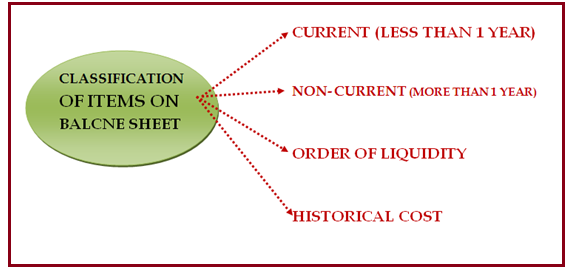

- Assets and Liabilities are stated at historical cost.

- Assets = Liabilities + Equity

- Owner Equity/Net worth – the amount that the owner has invested in the business

- Owner Equity = Assets – Liabilities

- Balance sheet denotes about the financial postion at a specific time, most cases it is the close of accounting period

- Asset – anything of value owned

- Liability – any debt or other financial obligation owed to someone else

- Based on usage of time we can classify the assets into 3 categories, which is mentioned below:

- Either in one year or

- in the operating cycle, whichever is longer

- Also termed as Non-Current Assets/Plant Assets

- Non current Assets are bifurcated into two:

- Intermediate assets – have a life greater than 1 year but less than 10 years

- Fixed assets – have a life greater than 10 years

- All intermediate assets are treated as long-term assets

- Capital Stock:Shares issued at Par value or no par value

- Additional paid in Capital:Excess to amount paid over Par value

- Retained Earnings: Undistributed Earnings

- Treasury Stock:It is shown as deduction from EQUITY

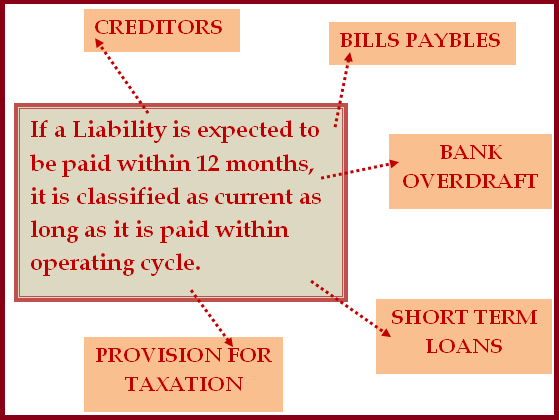

- Any Debts that company owes to creditors

- Purchases made on Credit

- Debt issued to Public

- We can divide Non current Liabilites into two categories

- Cheques\Bills discounted with bank

- Tax Disputes

- Legal issues

- Redeemable preference shares

- Debentures

- Term Loans and Public Deposits

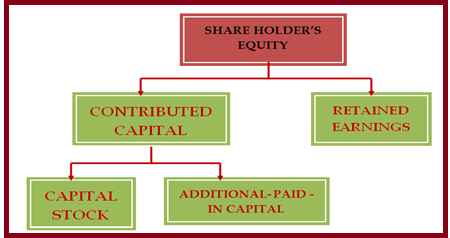

- Equity = Ownership Interest

- CONTRIBUTED CAPITAL also known as PAID-IN-CAPITAL

- RETAINED EARNINGS

- Capital stock: Number of Shares x Par Value

- ADDITIONAL PAID – IN CAPITAL: Investment by share holders in excess of par value of capital stock

- Summary of significant accounting policies

- Additional information to support summary totals

- Supplementary information required by the FASB\SEC to adhere to full disclosure principle.

- It provides financing without adding debt on a balance sheet

- Balance sheet accounts based on HISTORICAL COST., it doesn't denotes current market value

What is Asset?

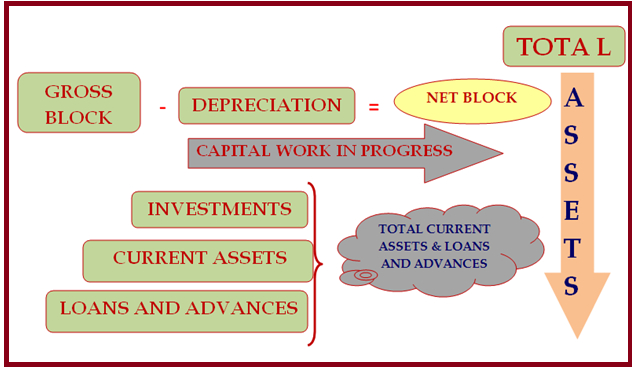

Balance Sheet Assets Structure

What is Liability?

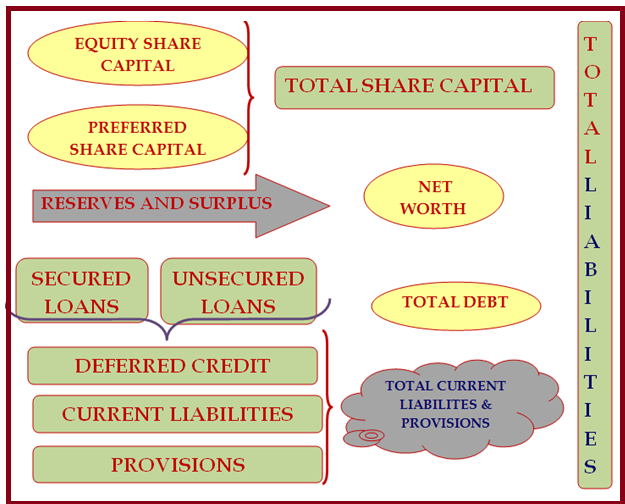

Liabilities Structure

Ways to Segregate Balance Sheet Items:

Balance Sheet Structure:

Balance Sheet Items

Transactions affects Balance Sheets

Classification of ASSETS:

State about CURRENT ASSETS:

Current assets are consumed, sold, or converted into cash:

We need to present CURRENT ASSETS in the order of liquidity

State about Non Current Assets

Ex:Machinery, equipment

Ex:Vehicles,Land, buildings

Equity Consists of:

A negative balance in the retained earnings account is referred DEFICIT

Liabilities

What is Liability?

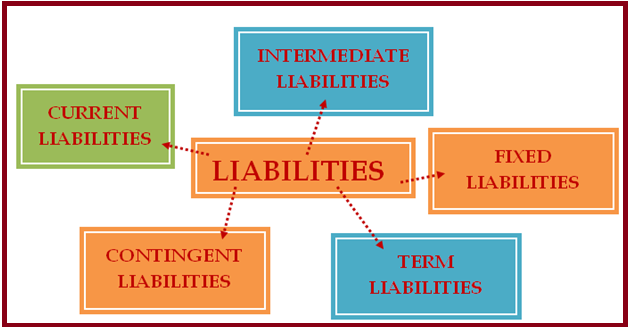

Liabilities Classification:

State about current Liabilites?

State about Intermediate Liabilites:

(i)Intermediate Liabilites: Repayment of liability happened between 1 to 10 Years

(ii)Fixed Liabilites: Repayment happened above 10 years

State about CONTINGENT LIABILITES?

All these are uncertain

What is “TERM LIABILITIES”?

Share Holder's Equity:

What is the difference between CAPITAL STOCK & ADDITIONAL PAID IN STOCK

State the items that company need to disclose in notes?

OFF BALANCE SHEET ITEMS

Limitations of Balance sheet

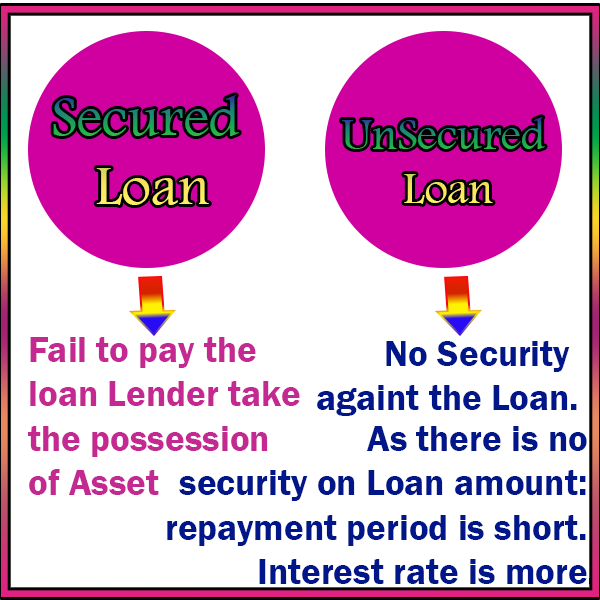

Difference between Secured Loan and Unsecured Loan