Ratio Analysis

Valuations

Charting Technique

- Also termed as MARKET BASED VALUATION METHODS

- It is an expression of market value

- (i)Enterprise Value

- (ii)Equity

- It denotes the value of entire enterprise

- It denotes the value of Share holders equity on Assets,earnings..

- Due to accounting treatment with respect to Policies i.e depreciation, interest rate calculation..

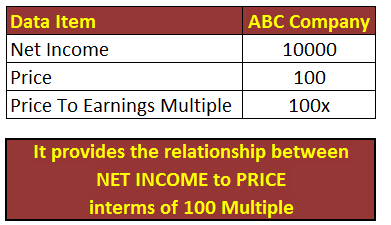

- Price To Earnings Multiples

- Price To Book Value Multiples

- Price To Sales Multiples

- EV/EBITDA Multiples

- EV/Sales Multiples

- PEG Ratio

Valuation with Multiples

What is Multiple

We can say there are two types of Multiples:

Enterprise Multiple:

Equity Multiple:

Variation between Multiples:

Company EPS x Average Price to earning ratio of the industry

Multipels with Enterprise value: