Ratio Analysis

Valuations

Charting Technique

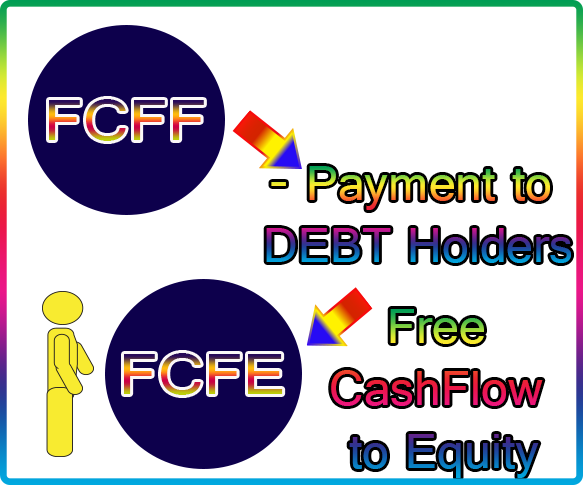

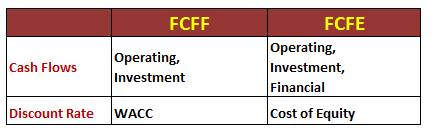

- FCFF: Free Cashflow to Firm

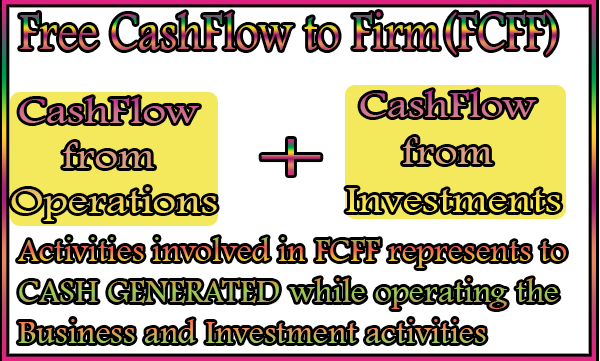

- FREE: After paying all the Expenses, Capital Expenditures left over to the company to pay the amount FREELY

- FCFE: Represents to Free Cashflow to Equity

- Amount left to Equity Holders After clearing payments to DEBT

- It is also one of the DISCOUNTED CASHFLOW(DCF) approach which is used to evaluate the FAIR PRICE of stock

- In FCFE Calculation Changes in NET BORROWINGS also considered along with OPERATING AND INVESTMENT activiteis

FCFF - Free Cashflow to Firm

FCFE - Free Cashflow to Equity

FCFE - Free Cashflow to Equity