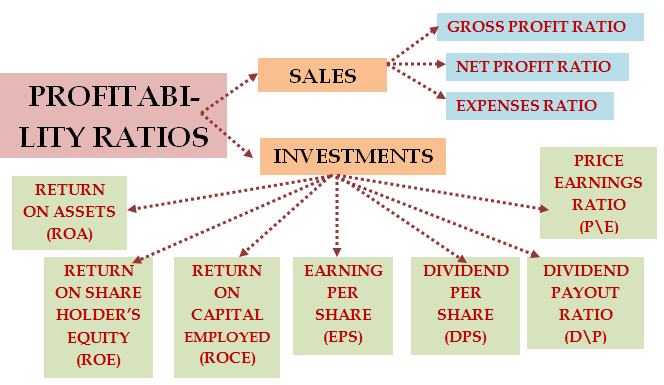

Ratio Analysis

Valuations

Charting Technique

- Profitability on Sales

- Profitability on Investment

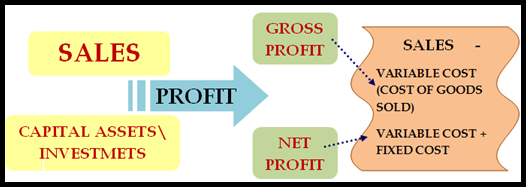

- Denotes about the profit generation from SALES

- Gross Profit = Total Revenue - Cost of Sales(variable cost)

- Net Profit = Total Revenue - Variable Cost + Fixed Cost

- This ratio is calculated by dividing Gross Profit by sales

- It represents in terms of % on Net Sales

- Higher the ratio is better

- A gross profit margin of 35% means that for every 100 rupess of sales, the firm makes 35 rupess in gross profit

- This ratio is calculated by dividing Net Profit by sales

- It represents in terms of % on Net Sales.

- Higher the Ratio: is better

- It denotes relation between TOTAL ASSETS and EARNINGS

- It evalueates how much profit generating by company for each RUPEE of Asset

- Denotes effective utilisation of assets by company

- Fictitious assets doesn't include in TOTAL ASSETS

- If the company doesn't have DEBT, Return On Assets & Return on Equity both are same

- This ratio measures relation between NET PROFIT – CAPITAL EMPLOYED

- It denots the relationship between the profit and the capital employed

- This ratio elucidates about the effective utilization of LONG TERM FUNDS OF OWERS and CREDITORS

- ROCE should always be higher than the rate at which the company borrows, else company doesn't have enough money to distribute to share holders

- It denotes the relation between PROFITS & OWNER’S FUNDS

- High Ratio is Better

- Denotes about Earnings per Each share

- Of the generated Income, actual amount declared as Divided by the company

- Denotes about Actual dividend paid to Investors

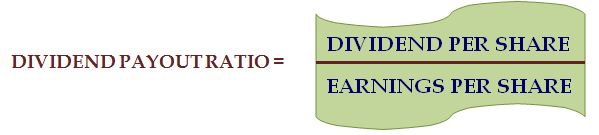

- It establishes the relationship between the earnings pertains to ordinary share holders and actual dividend paid to them

- This ratio denotes about the status of shares: (i)Under valued (ii)Over valued

- Higher P/E ratio denotes High Confidence

- Amount that the investor willing to pay for a company

Profitability Ratios

Profitability Ratio with respect to SALES:

Difference between GROSS PROFT & NET PROFIT?

Gross Profit Margin Ratio

Net Profit Margin Ratio

Profitability Ratios with - Investments

Return on Assets:

Retun on CAPITAL EMPLOYED(ROCE):

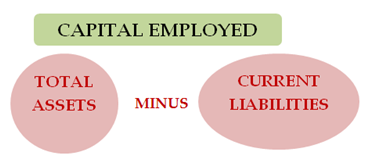

Capital Employeed:

(i)Gross Capital Employeed:It referres to Total Assets which is a combination of Fixed + Current

(ii)Net Capital Employeed:It referres to Total Assets - Current Liabilties

(ii)Net Capital Employeed:It referres to Total Assets - Current Liabilties

Capital Employeed: DEBT + EQUITY = CAPITL EMPLOYED

Capital Employeed = Fixed Assets + Net Working Capital

Retun on SHARE HOLDER'S EQUITY(ROE):

Share holder's Equity:

Earning Per Share

Dividend Per Share

Dividend Payout Ratio

Price Earnings Ratio(P/E)