Ratio Analysis

Valuations

Charting Technique

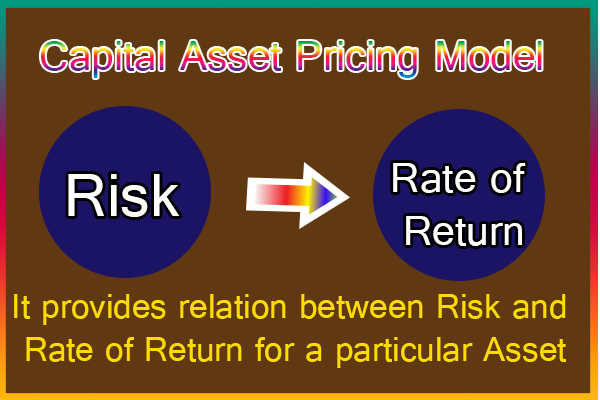

- It determines Rate of return of a Security after considering its risk

- It provides the relation between RISK and RATE OF RETURN for a particular asset

- It is used to calculate required rate of return of a risky asset

- Ra = Expected Rate of Return

- Rf = Risk free rate of Return

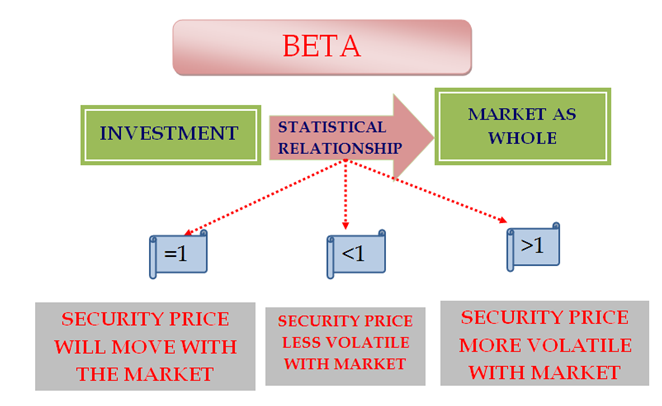

- Beta - Denotes about Risk

- Rm = Market rate of return

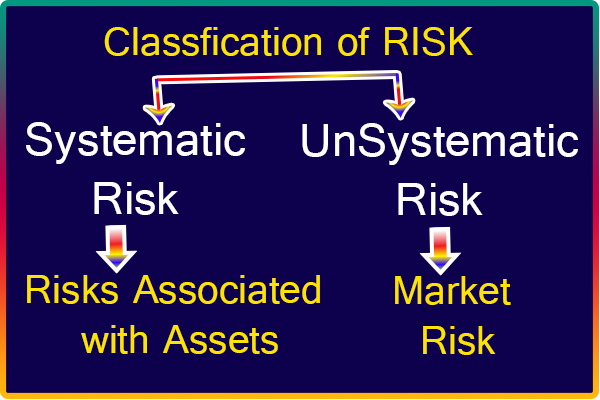

- We can classify risk in two

- UnSystematic Risk associated to Asset Specific Risk

- Systematic risk associated with RISK TO ALL ASSETS

- BETA calculates SYSTEMTIC RISK

- If Beta is > 1, asset risker than Market

- If Beta is < 1, Asset is less risky than Market

Capital Asset Pricing Model

Ra = Rf + Beta(Rm-Rf)

Beta = Risk Premium

Beta RISK Classification:

(i)Systematic Risk (ii) Unsystematic Rick