Ratio Analysis

Valuations

Charting Technique

- This method enables the user to define absolute value of the company

- It is the process of SUM of FUTURE CASHFLOWS, which is discounted at a particular rate

- FCFF: Free Cashflow to Firm

- FCFE: Free Cashflow to Equity

- Free CashFlow doesn't mean as NET INCOME

- It represents to CASH available for distribution to:

- Creditors

- Share holders

- Through this method we can evaluate the Investment Projects

- It is one of the method of valuation, which is very useful to value a company

- All the Futured\Expected cash inflows are discounted with particular rate

- In other words PROJECTING future cash flows and discount to PRESENT VALUES

- Calcuate Free Cashflow

- Calculate the Discount Rate

- 1)Project future CASH FLOW based on assumptions

- 2)Calculate Discount Rate through WACC method

- Weighted Average Cost of Capital

- The weighted average cost of capital

- Free Cashflows

- Terminal Value

- Enterprise Value

- Equity Value

- DCF Analysis entirely depended on PROJECTED NUMBERS

- It is nothing but amount not required to operations of the company

- Company can pay that amount in form of dividends to investors (or) Reinvest into business

- It entirely depends on company's discretion

- FCFF: Free Cashflow to Firm

- FCFE: Free Cashflow to Equity

- While calculating terminal value consider last projecting value., assuming company attains same level of profit through out the life

- Firm value vary from one analyst to another as they are approching different assumptions

- Determine Forecasting periods for projections and REVENUE growth

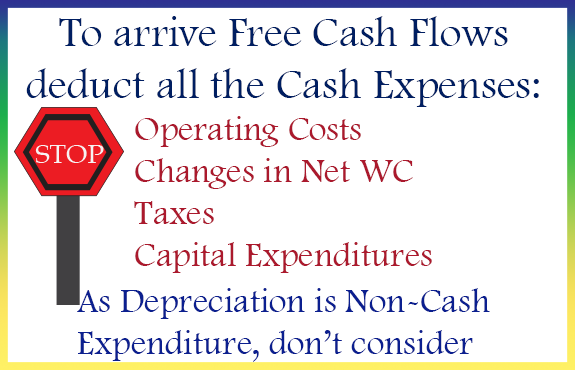

- Deduct the all the Cash Expendses

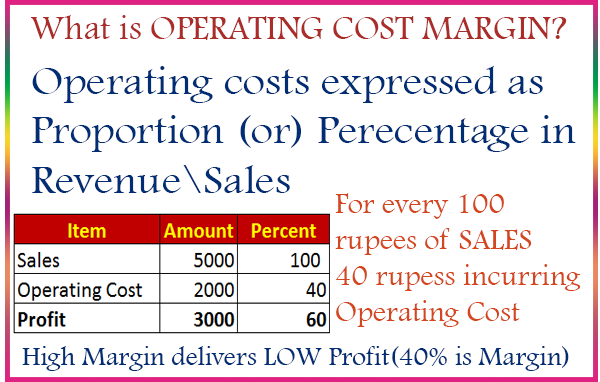

- It should be projected based on HISTORIC OPERATING COST MARGINS

- Consider based on latest applicable rates only

- High Working Cap results Low cash flows

- Forecast the working Capital based on growth in Sales

- Working Capital having proportional relationship with Sales

- Identify the Discount Rate through WACC:

Discounted Cashflow Model(DCF)

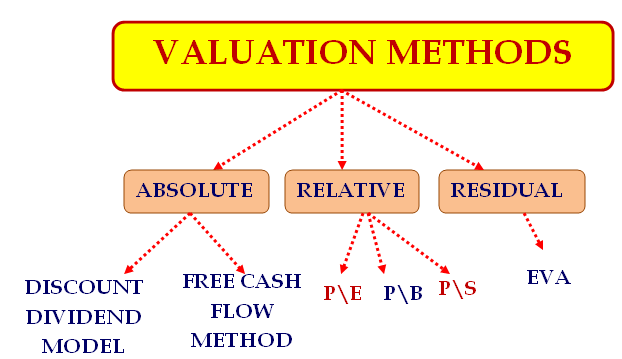

Valuation Methods

Free Cashflow method we can classify in two types

What is FREE CASHFLOW?

Discounted Cashflow Method

Steps to Follow:

Cost of Equity

Cost of Equity = Risk-Free Rate + Beta * Equity Risk Premium

Discount Rate:

We can retrieve discount rate through two methods:

Steps to follow to conclude DCF Value:

Points to Remember

Free Cash Flow:

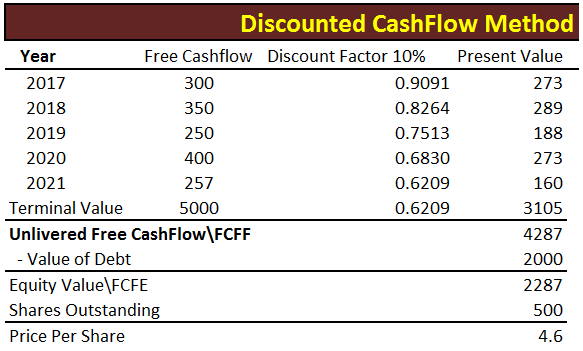

Example: Valuation of Firm and Equity through DCF ANALYSIS:

Calcualtion Procedure between FCFF & FCFE:

Why we need to discount future Cashflows?

Step1:

Step2:

Projection of OPERATING COSTS:

Taxes:

Working Cap:

Calculating Net Present Value of Future Cashflows